It has come to the Observer’s attention that Jennings suffers from many of the same municipal governance issues as Ferguson. With this story, we step into that fray, on behalf of the honest citizens of our neighbor city.

In the summer of 2018, the city of Jennings undertook an ambitious project. A great many properties, being six years delinquent on property taxes, had come to be available in the post-third tax sale. Municipalities are able to obtain these properties by paying a nominal transfer fee. Jennings obtained dozens of them.

Ferguson has a program where the city will obtain such houses for anyone wishing to rehab them. In order to obtain a house in Ferguson, the prospective owner must present a plan demonstrating the ability and resources to fully rehabilitate the home, most of which are in an advanced state of deterioration. The city charges an administrative fee of fifty dollars, limits participants to four homes at a time, and requires that participants be current on all real estate taxes for any property in Ferguson. And it specifically bars from the program anyone who previously lost properties for non-payment of taxes.

In Jennings, they took a different approach. The one page bid form imposes no requirements at all, aside from payment in certified funds, and registration of the vacant property with the city. And Jennings appears to be flipping these properties as a revenue source: The starting bids in the city’s April 2022 auction were as high as $5,000. The result of this haphazard program: Many of the homes appear to have been purchased by a speculator who is making no effort to improve them, and others have languished in the city inventory for years. And most seriously, the city appears to be providing favorable tax treatment to a few participants.

Trusted Properties LLC is owned by Raymond Patterson. Patterson is a Ferguson resident, in a neighborhood just a few blocks from Jennings. In a review of tax compromised properties in Jennings, an incredible number of them were awarded to Patterson, who quickly transferred them into individual LLCs for each property. To his credit, Patterson pays a great deal of property taxes on these homes.

Of the first dozen tax compromised homes we reviewed, 7 of them had been transferred by the city of Jennings to Trusted Properties. But when we visited the homes, we struggled to see where anything had been done to them. This house, at 8817 Eichler, is actually in better condition than many of the homes. Yet it languishes, an eyesore on a street which is already struggling. Patterson paid nearly $900 in property taxes on this vacant home last year.

A more curious situation is the several properties which are apparently owned by Blue Key Realty Solutions. That corporation is registered to a resident of the lofts at the corner of Delmar and 17th, a few blocks from the City Museum and Washington Avenue. County records show that Blue Key owns three properties in Jennings. All of those properties were obtained from the city, flipped from the post-third tax sale. Yet for some reason, although the ownership is changed, the properties remain listed as tax exempt municipally owned property.

This home, at 2007 Park, was obtained by the city in 2018. It was transferred to Blue Key in August 2020. While we saw nobody at home when we were there, it appears to be an occupied home and in good condition. The previous owner last paid taxes on the home in 2008.

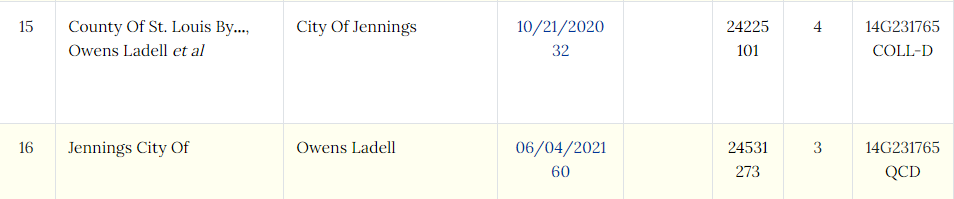

Most serious of all, in at least one instance, the city obtained a property from the county, had back taxes removed, and deeded it back to the tax delinquent owner. The house, at 7045 Garesche, is owned by Ladell Owens. According to state records, Owens owns a plumbing company, and Right Now Property LLC. County records show that Owens came to own the house, which was formerly owned by a corporation in California, in 2015. County records appear to show that taxes were unpaid at that time, having been last paid in 2011.

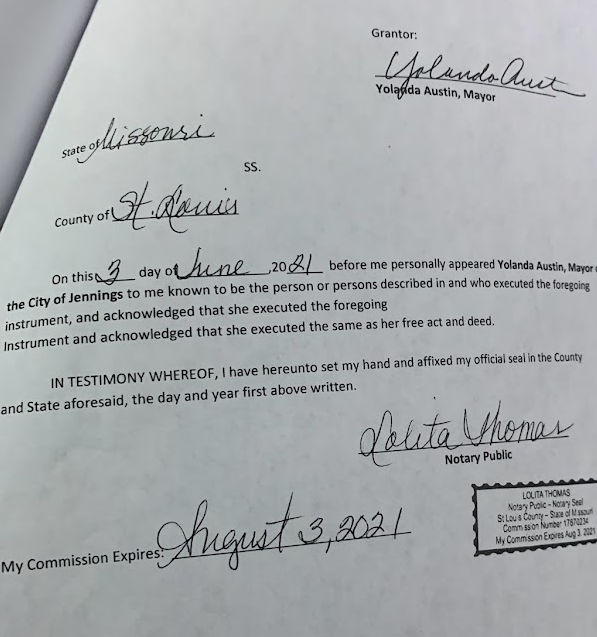

In October 2020, the county took the property for back taxes and deeded it to the city of Jennings. At that point, according to county records, there were ten years of property taxes owed. Upon transfer to the city, the tax debt was eliminated from the property.

According to a city source, “the property was not sold but rather deeded to the original owner after it was discovered that the property had tenants living in the house.” So a landlord is collecting rent, not paying taxes year after year, and the city’s response is to take the house from the tax sale and deed it back to the owner, taxes forgiven? We understand that the city might prefer not to sell the house to an unknown party, out of consideration for the tenant. But the original owner is absolutely barred from purchasing the home through the tax sale, as all bidders in tax sales must be current on their personal property and real estate taxes. Even family members of the tax delinquent owner are required to pay “all outstanding delinquent taxes, penalties and fees.” A more reasonable solution here would have been to deed the home to tenant, whose rent should have been paying those tax bills in the first place.

Jennings residents are acutely aware of the vast number of abandoned properties in their neighborhoods. With the city taking an approach to maximize their own revenue, tax delinquent abandoned properties could be placed in the hands of speculators, rather than people who are willing to repair these properties and return them to service. We’ll update you on where Jennings goes from here.