The first justification for the large tax increase proposed by the city, through the mechanism of spinning off the fire department, is that we face a budget crisis. In Saturday’s column, we showed that while our city budget has its ups and downs, long term trends don’t justify the panic which city officials seek to induce. But of course, the restrictions imposed by the county during 2020, as a result of COVID-19, reduced some economic activity last year. That, in turn, could result in lower city revenue.

It has long been my contention that it’s inappropriate to hike taxes on residents so that government is held harmless. Government officials and public employees often express the attitude that it would be unfair for them to be hurt because of an economic downturn. But of course, the rest of us are hurt during an economic downturn. I believe that holding the government harmless during a downturn by imposing higher taxes on the public which is already suffering from the downturn is fundamentally unjust. But that’s a conversation for another day, because in this case, government is being held harmless.

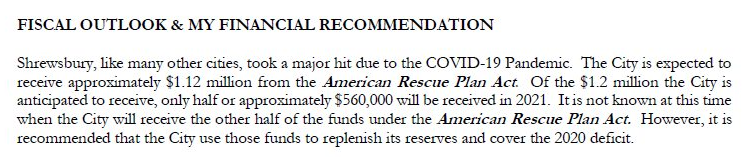

In a recent conversation, a friend from Shrewsbury shared a message from their director of finance to their city council. In that message, he said that Shrewsbury, with a population of about 1/3 that of Ferguson, expected to receive more than a million dollars from the American Rescue Plan Act.

He recommended they use those funds to replenish city reserves and cover the 2020 deficit – that is, to erase the negative impact which COVID had on their city, leaving them in a better position than before COVID.

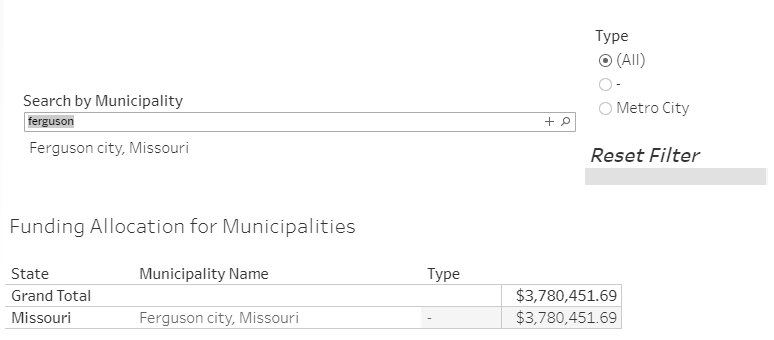

So what about Ferguson? In a fair presentation about our city’s financial condition, you wouldn’t mention the hardship of COVID without also discussing how much the city would be receiving in federal funds to mitigate that hardship, right? Of course, that didn’t happen, so we did the research ourselves. The National League of Cities has a web page where you can look up how much your city can expect to receive from the American Rescue Plan Act. And to save you the trouble of clicking, here’s how much Ferguson should be planning to get:

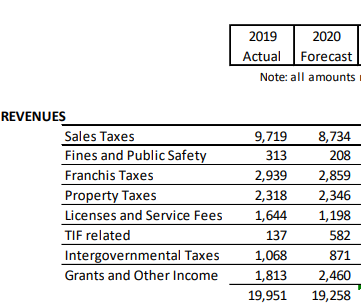

So we’re getting $3.8 million to help us through the pandemic. Next question is, how much did the pandemic hurt us? Let’s start by looking at where the city gets its money. This chart is from the most recent city budget:

Sales taxes make up nearly half the budget, and because of their volatility, are presumably the line which the city expects to be the big loser in the pandemic. So how did sales tax revenue hold up during the pandemic? I couldn’t find a report for St. Louis county, but the state has great monthly revenue reports. Here’s how sales tax looked last year: For the fiscal year ending in June 2020, sales tax increased by 1.75%. And the second half of the year was even better: The fiscal year to date report in December, which includes revenue starting in July, sales tax increased by 3.6%. The report for January-March 2021 had sales tax up by 3.3%. And the economy is still far from fully recovered.

Now of course, statewide figures may not be exactly the same as our experience in the St. Louis county sales tax pool. But if statewide sales tax proceeds are increasing, it is very likely that they are increasing in St. Louis county also. Fortunately, while the county doesn’t have the exact report I need to determine this, they come close with their quarterly Proposition P report. As you may recall, Proposition P is a sales tax which is used to fund law enforcement. An increase in Prop P revenue would directly correspond to an increase in general sales tax revenue in the county. We retrieved those reports from the county website, and summarize them here:

| 2020 | 2019 | |

| Q1 | 16,800,556 | 13,589,622 |

| Q2 | 11,207,607 | 11,871,759 |

| Q3 | 12,214,364 | 13,474,862 |

| Q4 | 11,839,779 | 8,499,257 |

| Total | 52,062,306 | 47,435,500 |

St. Louis county Proposition P revenue was up nearly 10% during 2020. So Ferguson sales tax revenue could actually be higher in 2020. And the city is receiving a one time bonus from Washington of nearly $4 million. Does this sound like a crisis that demands a large tax hike on every resident of Ferguson?