The sentiment that a man’s home is his castle can be traced back to ancient Rome. In the case of the Versailles Apartments in Ferguson, where residents shiver in apartments without heat and hot water, and are stalked by dogs and gangs in the hallways, the proverb does not fit. In recent actions by inspection officers, the city is attempting to force owners to abate a long list of issues, but that effort has produced very little improvement.

New Owners

The Versailles Apartments, a single building of 100 units, sits just off West Florissant, behind an auto repair shop. Originally developed for senior citizens, it is a 4 story building with two wings. The original developer, Fountain Lane Development, was incorporated in 1959, ten years before they built The Versailles. Fountain Lane, whose registered agent was real estate power attorney Steven Stone, was administratively dissolved in 2009. Corporate records dating back to 2000 indicate that Steven Stone served as both Vice President and Secretary of the corporation, while the President was his father, the late Sidney Stone.

In 2009, the building was sold to Versailles Partners, for $2.6 million. In September 2021, it was purchased by the present owner, Versailles SPE LLC. While state corporate records reveal little about LLCs, the mailing address of the corporate office leads us to Hughes Private Capital. Hughes is an investment firm which seeks individuals who are either real estate owners, or have substantial cash or retirement funds available. Investors are required to have a net worth of $1 million, or an individual annual income of at least $200,000. According to their website, they pay a guaranteed monthly income regardless of the performance of the individual properties. The current guaranteed interest rate is 7%.

Corporate records indicate that the local agent is Valetta Sullivan, the managing broker for the St. Louis office of Krch Realty. Krch is a national firm which appears to specialize in investment clients. Their office is located in a strip mall on Shackleford Road, between an Italian restaurant and a gas station. While Krch would be responsible for legal service, the day to day management is provided by Radius Realty. On their website, Radius offers property management and renovation services, and a directory of homes for rent. Court records show Radius as plaintiff for about fifty evictions this year, including a few from Versailles.

Big Ticket Problems

A real estate investor who is familiar with the property noted that there are both big ticket problems, and a large amount of deferred and substandard maintenance, all of which would be costly to resolve. Among those issues:

- The building was originally designed to be heated and cooled by a single, large system. Located in an abandoned furnace room on the top floor, this system has been replaced by individual air conditioning units for each apartment, along with an electric furnace. The furnaces, located in the ceiling just inside the door of most units, have been an ongoing headache. Drainage of air conditioning condensate is a chronic problem, resulting in mold and water problems throughout the building. Recent work appears to have been done without city permits. The investor estimates a cost of $300,000 to bring HVAC systems into proper operating condition.

- A variety of small plumbing issues plague the apartments. The investor expects that these repairs would cost $150,000. But there are more serious issues which would run that bill much higher. The internal sewer stacks, cast iron pipes which are more than 50 years old, have started to leak. The sewer lateral is in urgent need of replacement, which is itself expected to cost $125,000. The hot water supply pipes have filled with sediment, a problem which can be temporarily remedied by flushing, but which ultimately requires replacement. Realistically, the entire building will get new plumbing.

- The old water heater was replaced with a system that is undersized, resulting in a lack of hot water which can only be resolved by a great expansion of the system. The existing system, which is less than a year old, has four commercial tankless heaters, and two 120 gallon storage tanks. The heaters can produce a maximum of 199,000 BTU, and support a flow rate of up to 11 gallons per minute. But at that flow rate and heat supply, 60 degree water will only reach 96 degrees. Since code requires hot water at a minimum of 100 degrees, water heater systems in apartment buildings target 140 degrees, to ensure proper temperature for the most distant units. According to an online calculator, heating 60 degree water to 140 degrees in a 199,000 BTU unit will allow a flow rate of 5 gallons per minute. Also, storage capacity for each 50 unit segment should be at least 210 gallons. Reworking the hot water system to meet load requirements will cost about $25,000.

- Fire doors on units, required by current code, $125,000.

- Replacement of elevators, which are very old and fail often, $160,000.

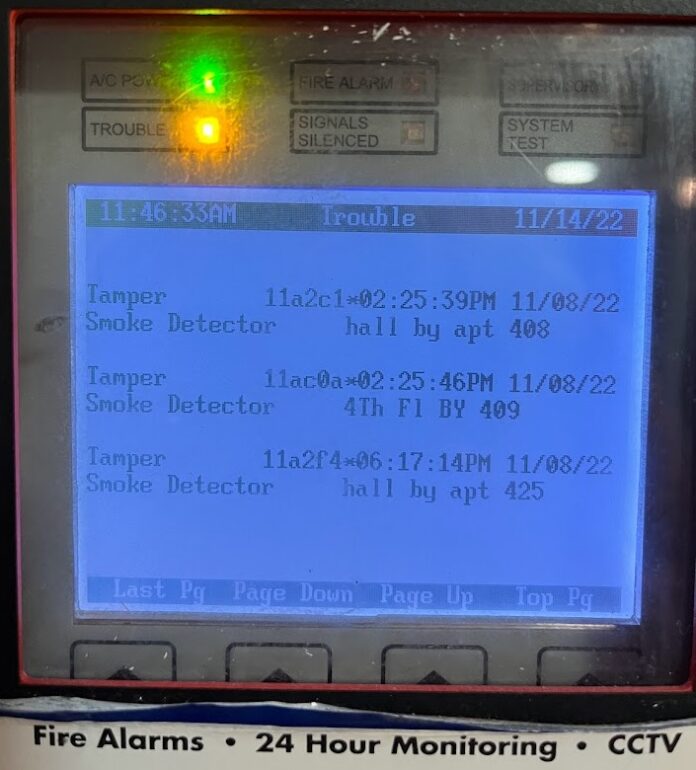

- Central fire alarm and sprinkler system, $400,000.

This investor estimated a total spend of about $3 million to remedy all deficiencies and bring the units and common areas up to a decent standard. These big ticket items mean that in today’s market, the building is worth about half of what the current owners paid.

Immediate Prospects

Given the serious health and safety needs of the building, and the unlikelihood that the current owners will invest the substantial amount needed to remedy them, it is most likely that the building will continue to decline. It is impossible for any unit to pass an occupancy inspection until the hot water and fire code issues are resolved. That means the building will slowly empty out, and losses will mount. An owner with outside financing would probably end up in foreclosure. This owner is working with investor money, so it’s a different situation. Hughes Capital allows investors to withdraw funds with a 90 day notice. If this is a small enough part of their portfolio, and it doesn’t trigger a “run on the bank” they may be able to stand through a loss.

But even if the loss doesn’t break the bank, the owner has a strong incentive to cut their losses. Despite being unable to obtain occupancy permits, they have not repaired or replaced the fire alarm system, which could result in a mass casualty event. And lack of hot water is a deficiency with serious consequences, as residents are unable to bathe and clean. The city can’t allow that situation to continue in an occupied building. And now that the situation has received media coverage, a swift resolution must be sought. Clearing the building of occupants through condemnation, before the end of the current year, is almost inevitable.

An inquiry to the director of the St. Louis County Housing Authority on November 17 had received no response at the time this article was published. But the housing standards required by Section 8 are far more detailed than the Ferguson city inspection. To the extent that residents are receiving Section 8 assistance, they will have to leave.

City in the Hot Seat

The city has attempted to pressure the owner through a media tour which has now included an article in the Post-Dispatch and a story on Fox 2 News. But these stories point not only to the poor performance of the landlord, but to the failure of the city’s housing regulations. Under Ferguson’s Responsible Landlord Initiative, rental properties are supposed to be inspected before occupancy, and landlords are held accountable for the condition of their property and the conduct of their tenants. Nuisance landlords are subject to punitive action.

But while the city has collected the $50 a year fee for every rental property, and has maintained fairly consistent standards on single family rentals, the apartment complexes on West Florissant have not been subjected to the same standards. In 2018, a walkway collapsed at Park Ridge Apartments, which was then owned by T.E.H. Realty. At that time, Section 8 inspectors found deficiencies in all but one of the twenty buildings in that complex, according to the Post-Dispatch. Since that crisis, new owners and improved management have reportedly resolved the problems at that complex. Similar issues have persisted at other apartment complexes in Ferguson, though none have been so serious as Versailles.

The city now faces a Hobson’s choice: allow tenants to continue to live in a building which violates the most significant health and safety requirements, or force nearly a hundred families to find new housing in a market with limited availability and high prices. For those who have been inconsistent in paying their rent, some of whom are having rent paid through a state program for Covid related assistance, it may be impossible to find housing at all. And then, Ferguson will be back in the news.