Every two years, the county assessor sets the value of your home. If you are a homeowner, this may change the amount of your property taxes. This is the first of a two part series, in which we will help you to understand that letter you just got in the mail, and give you a guide on what you can do about it. This is not legal advice, and if you require legal advice, you should consult an attorney.

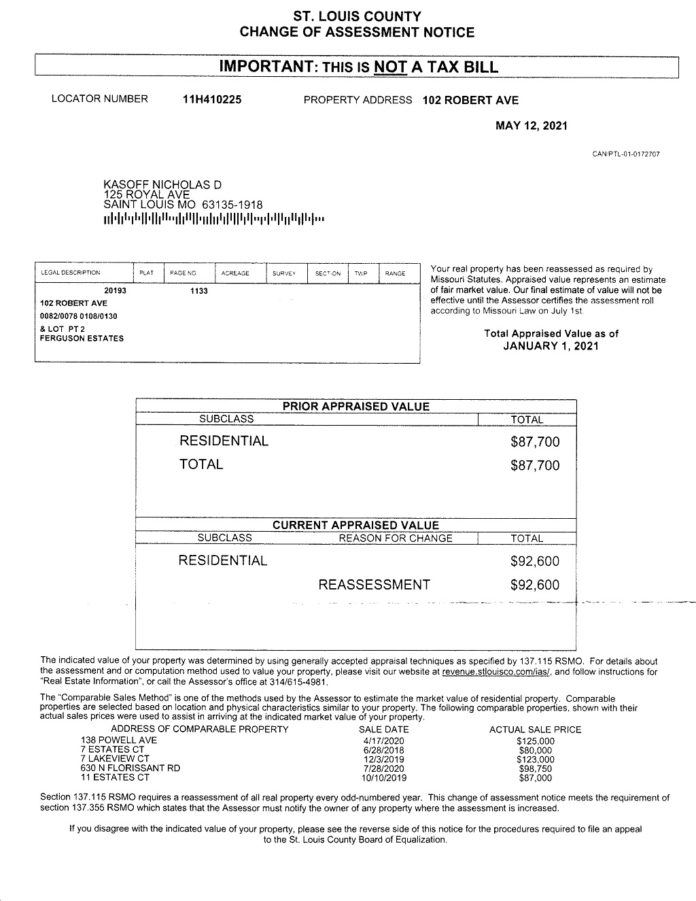

If you’re a Ferguson homeowner, you’ll be receiving an important piece of mail from the St. Louis county assessor very soon. The report they are sending you is notification of how much they think your home is worth, and what you’ll be paying in taxes for the next two years. There’s a lot of information in that report, so here’s the breakdown on what it means to you:

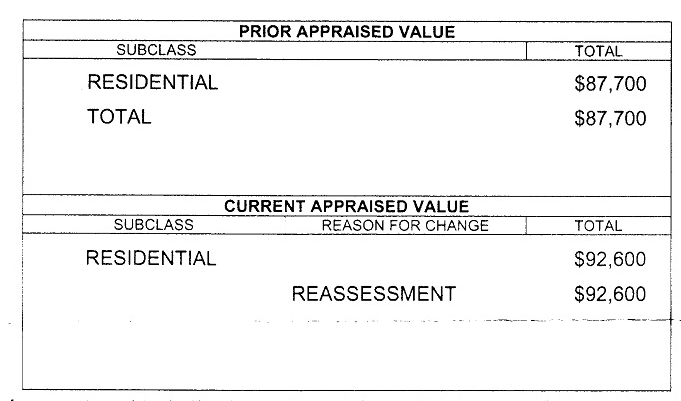

Previous and current value. On the front of the report, in large print, they tell you what your home was worth last time, and what they believe it is worth now.

For most of us, value has increased this year. But as we’ll discuss shortly, that may not be anything to worry about. The value is a reflection of upgrades to your property, but more important, of general market conditions for similar homes in your area. For most homes, they will provide “comparable sales” at the bottom of the front page.

Value is to be set as of January 1. Under state law, the comparable sales must be reasonably recent, nearby, and similar in size and construction. While they list only the addresses and prices, their calculation must take into account the details of each property, and adjust the sale price accordingly. If they consider your house to be unique, there may be no comparable sales listed. In that case, they use an “alternative method of valuation.” Unfortunately, they have no obligation to tell you how they came up with your value, and in fact they will not do so. State law specifies that the county’s valuation, as affirmed by the Board of Estimate, is presumed to be correct. If there is anything wrong with your case, even if the county’s value is wildly incorrect, you will lose. If you appeal to the state tax commission, the county must appear, but their only piece of evidence will be their assertion of your value. Because they presented no evidence, you don’t get to question them as to how they arrived at their value, but they will attack yours. That’s what passes for due process in assessment appeals.

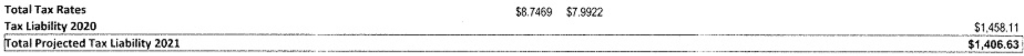

Now, once they’ve set a value, they calculate your tax amounts. And here’s where it gets tricky: Taxing districts are entitled to a “cost of living” increase, and to additional revenue from new development, but they are not permitted to increase taxes simply because overall property values rose. So for each taxing district, in a time of increasing value, tax rates will be decreased to comply with this. So in the above example, value increased from $87,800 to $92,600, but taxes decreased from $1,458 to $1,407. This can be found at the bottom of the back page of the notice:

In Ferguson, the municipal tax rates are all at the limit, and were not reduced. But the school district levy dropped by 66 cents, accounting for nearly all of the reduction in taxes. Since the school district levy is below the limit, the board could vote to increase the tax rate, and no public vote would be required. The tax rates for each district are listed on the back of the notice. It’s an interesting exercise in civics to review that list.

So, now you know what they’re telling you with that notice. In our next article, we’ll help you decide whether you should appeal, and give you some layman’s tips on the process.